Card Lock and Using it to Protect your Money

Here’s everything you need to know about this card security feature, and how Card Lock can help protect your money.

Have you ever had a fun evening out on the town, only to realize your card is no longer in your pocket? Did it fall out at the movie theater? Or maybe at the restaurant? We’ve all been there – the feeling of alarm as you try to mentally retrace your steps and track down your card. All while hoping no criminals find your card first. Good news - now you can lock your card! Here’s everything you need to know about this card security feature, and how Card Lock can help protect your money.

What Card Lock is

Card Lock is a security feature that allows you to block new authorizations on your debit and/or credit card. If you've misplaced your card, blocking can prevent criminals from using it without reporting it as lost or stolen. Once you find your card, you can unlock it and use it normally.

How Card Lock Works

If you Lock your card, all new transactions will be declined. If an attempt is made to use the blocked card, we will send you (the cardholder) a notification. We will contact you by push notification, SMS message or email and inform you that the card has been rejected because it has the status "locked". Your card will remain locked until you decide to unlock it. You can also Lock your card as often as you like.

Afraid of forgetting which cards are locked? No worries. You can see which cards are locked when you log into Jefferson Bank Online Banking or the Mobile Banking App.

Transactions that are Allowed While Locked

Any recurring or automatic charges the merchant sets up correctly will still process as usual. When a merchant sets up an automatic payment, part of their process is adding an indicator, which shows the transaction happens continually. For example, subscriptions, streaming services, memberships, or automated billing payments will still process.

Here are a few examples of recurring, automatic bill payments:

• Cell phone bill

• Utility bill

• Cable or streaming service bill

• Gym membership

• Subscription boxes for food, clothing, beauty, and pet supplies

• Magazine subscriptions

The merchant will need to set up any recurring charges correctly, otherwise Card Lock will block the transaction. You probably don't need to take any action - setting up a recurring transaction is something the merchant tags on their side. So, when it comes to subscription services, they can be helpful, but the cost can add up quickly. Check out these five tips for budgeting for your subscription services.

Here’s When you Should use Card Lock

If you've lost your card and can't find it, block the card to prevent further purchases until you find it. Your card will be blocked from new authorizations until you choose to unlock it, so if you stop looking for the card, report it as Lost/Stolen and we will reissue you a new card.

In addition to keeping your money safe, there are other popular ways to use Card Lock.

• Spending controls – Smaller, more frequent purchases can add up fast. If you’re wanting to limit impulse buying, try keeping your cards locked until you need to make a purchase. The short amount of time it takes to unlock your card, may help you decide against buying something you may not need.

• Not often used credit cards – Locking credit cards you don't use regularly can provide additional protection. Having a long history with a credit card will help increase your credit history. So unless it's a card you use regularly, consider locking it rather than closing the account.

• Protective security – It may be a good idea to lock your card if you learn of a breach at a place where you normally shop or where you recently shopped. Card Lock blocks the card number and prevents the scammer from using the card information online.

Locking your Card

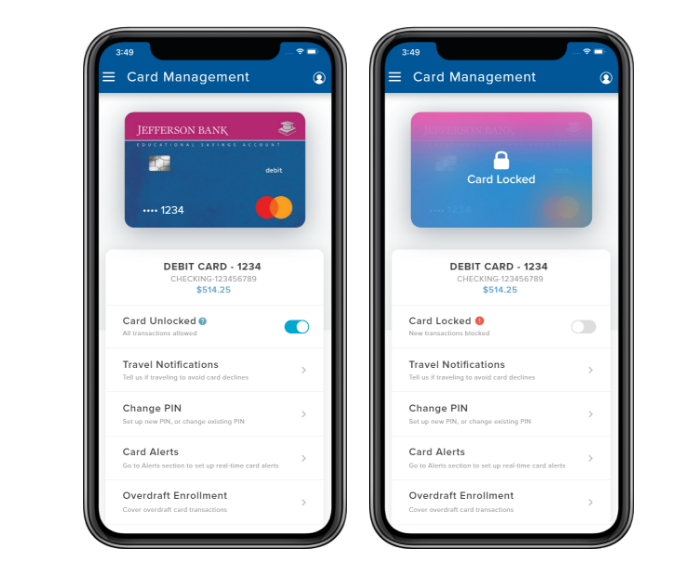

To lock your card, log into Jefferson Bank Online Banking or the Mobile Banking App. Under Card Management, select Card Lock. Toggle the switch “off” to lock your card and block new transactions. Any existing, recurring charges will still process while your card is locked. Ready to unlock your card? Just toggle the switch “on” to allow all transactions.

Using Card Lock is not a substitute for cancelling your card. If your card is truly lost or stolen, the most important step to protect your account from unauthorized use is to report it to your bank. As always, we’re here to make banking easier for you. If you have any questions about Card Lock, or if we can assist you in any way, don’t hesitate to contact us.